The PZU brand’s traditions date back to 1803 when the first insurance company was established in Poland. Currently, the PZU Group is the leader on the Polish insurance market and is one of the leading insurance and investment firms in Europe. The Group’s operations are concentrated in 3 areas: Insurance, Investments and Health.

We provide peace of mind when thinking about the future.

The Capital Group of Powszechny Zakład Ubezpieczeń SA (PZU Group) is one of the largest financial institutions in Poland and in Central and Eastern Europe. The Group is led by Powszechny Zakład Ubezpieczeń S.A. (PZU, Issuer) – a company quoted on the Warsaw Stock Exchange.

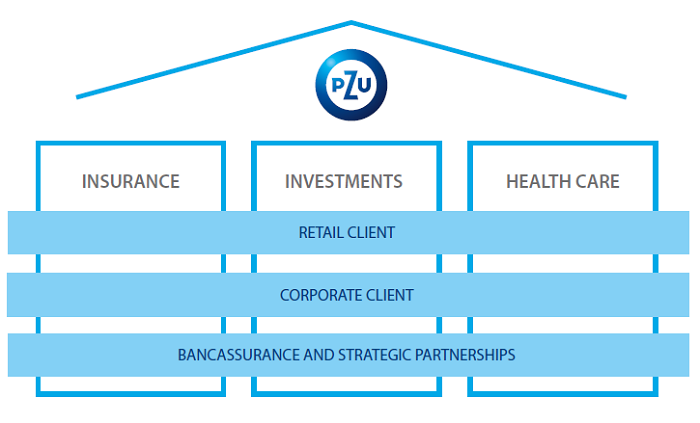

PZU Group’s activity is focused on the following 3 areas:

Insurance - PZU Group offers a broad range of insurance products. The gross written premium for 2015 reached the record value of PLN 18.4 billion. PZU and PZU Życie are the leaders of the insurance market in Poland; The Group is also the leader in the Baltic states and a major player in Ukraine - total written premium gathered on these markets in 2015 constituted 7.4% of the Group’s gross written premium.

For years, the most important element of the Group’s activity has been insurance, representing over 90% of the profits.

Investments – PZU is the biggest asset-management company on the Polish market. At the end of 2015, the assets of external clients managed by TFI PZU and PTE PZU amounted to PLN 25.3 billion. PZU is also the unquestioned market leader in employee pension programs, managing 509 EPP with total assets exceeding PLN 4.6 billion. High competences concentrated in scope of TFI PZU and PTE PZU provide the potential for acquiring important assets of both individual and institutional investors from the market. The activity of the Investments segment focuses on taking advantage of the extensive asset management experience and skills and offering more niche investment funds besides traditional closed and open ones (stock, mixed, stable growth, debt, etc.), such as PZU Energia Medycyna Ekologia, FIZ Akord, FIZ Dynamiczny, i.e. funds operating in a specific market segment and attempting to produce above-average management profits, not correlated with changes to market indexes (the so-called absolute rate of return funds).

Simultaneously, PZU holds a considerable portfolio of own investments which constitute more than insurance liabilities.

Health – developing the health insurance and health care services segment from 2014, PZU is cooperating with 1,580 health care centers (hospitals, clinics, counseling centers). The Group is simultaneously expanding the portfolio of own medical establishments.

PZU Group plans to become an integrated operator of coordinated health care by building a comprehensive product offer, creating a network of own medical establishments supported by the nationwide external network, and providing unique and customer-friendly service and appointment organization model.

The activity undertaken in scope of the area of Health segment takes advantage of PZU’s long experience in medical policies. The purpose of PZU health insurance and medical subscriptions is to provide services at private medical establishments with qualified staff and high quality diagnostic equipment. With current PZU’s offer, patients are allowed to take advantage of extensive medical care – from diagnostics, through treatment, to rehabilitation. The activities in this segment will successively raise the number of medical establishments open to the Group’s clients. By offering medical services to the patients, PZU simultaneously guarantees the high quality of said services.