The PZU Group’s high capital safety ratios place it among the insurance groups with the greatest capital strength.

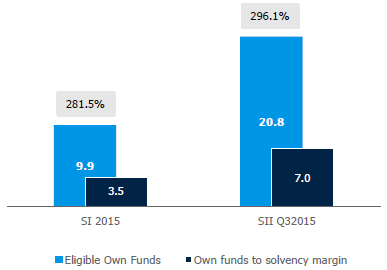

PZU Group holds exceptionally high capital security ratios in comparison to other insurance groups. And so, in accordance with the regulations of Solvency I, PZU Group held a 281.5% ratio of solvency margin coverage with own funds at the end of 2015.

On 1 January 2016, the Act on Insurance Activity of 11 September 2015 introduced new capital requirements – Solvency II – into the Polish legal systems. In accordance with the new act, calculation of the capital requirement is based on the following risks: market, actuarial (insurance), counterparty insolvency, catastrophe, and operating. As at the end of the third quarter of 2015, the solvency ratio (calculated according to the Solvency II standard formula) was assessed at a level of 296.1%. Ratios as high as these place PZU Group among insurance groups with top capital strength.

Solvency according to Solvency I and Solvency II* (%)

*Data according to SII was not subject to audit

From 2009, PZU is subject to regular ratings by Standard & Poor’s. On 21 January 2016, Standard & Poor’s rating of PZU was lowered from “A“ to “A-“ with negative rating outlook. The decision to lower the rating of PZU resulted from the lowering of Poland’s rating from “A-” to “BBB+” with “negative” outlook one week before and had no association with the situation of the company, the activity of which presents a very high capitalization and security level. According to the rating methodology, PZU’s rating can only be one grade above that of its country, therefore the maximum possible S&P rating for PZU is -“A -”.