In October 2015 a PZU Group company with its registered office in Sweden — PZU Finance AB issued bonds with a total value of Euro 350 million.

On 16 October 2015, PZU Finance AB (a public company), subsidiary of PZU Group seated in Sweden, issued bonds of the total value of EUR 350 million. These bonds were assimilated and together with eurobonds at the value of PLN 500 million issued by PZU Finance AB (a public company) on 3 July 2014, they constitute one series, a so-called „tap” issue.

Senior bonds issued in 2015 were purchased by approximately 60 investors (28% from Poland, 23% Holland, 18% Great Britain, 12% Czech Republic, and 9% Germany). The issue price per bond with a nominal value of EUR 100,000 amounted to EUR 99,218. Bond yield was 1.593%. The bonds bear interest at a fixed interest rate of 1.375% per year and the coupon will be paid once a year. The issue was awarded S&P rating at „A-”; yet, as a result of lowering PZU rating to „A-” on 21 January 2016 due to the S&P’s decision to decrease Poland rating from „A-” to „BBB+” for long-term liabilities in foreign currencies, the rating of PZU bonds dropped to the„BBB+” level.

The funds obtained from the bond issue were to increase the exposure in the investment portfolio to investments denominated in Euro, to manage the FX position and to harness inexpensive debt financing.

The bonds are quoted on the regulated market of the Irish Stock Exchange and the Warsaw Stock Exchange Catalyst ASO/Bondspot market.

The funds from the bond issue were planned to be used to increase the involvement of investment portfolio in investments denominated in euro, mange FX position, and use of debt financing, which is cheaper than equity.

The issue of Eurobonds constituted the implementation of PZU Group’s investment strategy in the scope of the management of the matching of assets and liabilities denominated in euro. PZU Group debt ratio as at 31 December 2015 amounted to 22.6%2

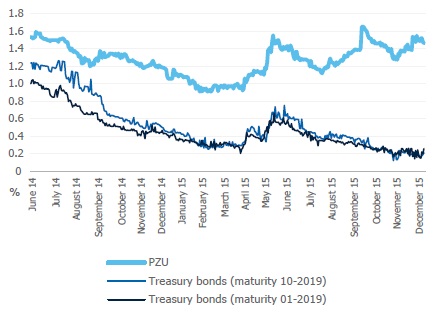

Yield of PZU eurobonds vs. Polish treasury bonds maturing on 2019 (euro)

Source: Reuters

2 debt ratio calculated as the sum of liabilities from credits, loans and issuance of own debt securities to the sum of own capital and these liabilities.