The major objective of pursuing the PZU Group’s capital and dividend policy is to reduce the cost of capital by optimizing the structure of the balance sheet. This is done by replacing equity with less expensive external capital while ensuring a high level of safety and retaining growth funds.

On 13 May 2014, the Management Boards for PZU decided to update the Capital Structure and Dividend Policy of PZU Group for the years 2013-2015 (Policy), approved on 26 August 2013. Thanks to the introduced changes, on 19 November 2013 an advance dividend expected at the end of 2013 financial year in the amount of PLN 1,727 million, that is, PLN 20.00(before stock split) per share, was recognized as part of the payment of the surplus capital.

The key objective of the implementation of the Policy is reduction of the cost of capital through optimization of the balance sheet structure by way of replacing equity with less expensive borrowed capital at the same time ensuring high security and maintaining funds for development.

The policy aims to increase the total shareholder return (TSR) and is based on the following principles:

- maintaining the own funds of PZU Group, excluding the subordinate debt, at the level not lower than 250% of the solvency margin (according to Solvency I) of PZU Group and an attempt to maintain the own funds of PZU Group, including the subordinate debt, at the level of about 400% of the solvency margin (as at the end of the financial year) in order to maintain the financial security of the Group;

- maintaining assets to cover the provisions of individual companies of PZU Group at a level not lower than 110%;

- obtaining an optimal financing structure by replacing the capital surplus with subordinated debt up to an amount no higher than PLN 3 billion;

- maintaining the equity level corresponding to Standard & Poor’s AA rating;

- providing funds for development and acquisitions in upcoming years;

- no share issues by PZU in the upcoming years.

The policy assumes dividend payment calculated based on:

- consolidated net profit where the amount of the dividend paid cannot be lower than 50% or higher than 100% of the net profit shown in PZU Group’s consolidated financial statements compliant with IFRS; and

- surplus capital, where the total amount of dividends paid from surplus capital in 2013-2015 cannot exceed PLN 3 billion.

PZU is planning to amend the capital and dividend policy to address the requirements of Solvency II.

Dividend paid by PZU from profit for 2011-2015 financial years

| 2015 | 2014 | 2013 | 2012 | 2011 | |

| Consolidated net profit of PZU Group (in PLN million) | 2,342.2 | 2,967.6 | 3,295.0 | 3,253.8 | 2,343.9 |

| Standalone income of PZU (in PLN million) | 2,248.5 | 2,636.7 | 5,106.0 | 2,581.0 | 2,582.0 |

| Dividend paid per year (in PLN million) | n/a | 2,590.6 | 4,663.0 | 2,564.7 | 1,936.9 |

| Dividend per share per year (in PLN)** | n/a | 3.00 | 5.40* | 2.97 | 2.24 |

| Dividend as at the date of establishing dividend right (in the year) | 3.00 | 3.40 | 4.97 | 2.24 | 2.60 |

| Dividend rate in the year (%) *** | 8.8% | 7.0% | 11.1% | 5.1% | 8.4% |

| TSR (Total Shareholders Return) | (23.9)% | 15.8% | 14.1% | 48.7% | (5.8)% |

* dividend from surplus capitals paid in 2013 (PLN 2.00 per share), not included in dividend payout ratio

** historical data was calculated in 1:10 ratio as per stock split

*** the rate calculated as dividend as at the ex-dividend date vs. share price as at the end of the given year

Payment of dividends for 2014

On 30 June 2015, the General Shareholders’ Meeting of PZU adopted the resolution on distribution of the net profit for the year ended 31 December 2014 in which it decided to allocate to the dividend payment the amount of PLN 2,590.6 million, i.e. PLN 30.00 per share (before split). 30 September 2015 was chosen as the date according to which the list of shareholders entitled to the payment was established. Dividend was paid on 21 October 2015.

Payment of dividends for 2015

On 1 December 2015, PFSA issued a recommendation on payment of dividend from profit generated in 2015. The supervisory body recommends that the insurance companies continue their prudent dividend policy using the generated profit to enhance their capital standing.

From its IPO PZU has distributed dividends totaling nearly PLN 15 billion. The dividend paid in 2015 was almost PLN 2.6 billion, yielding PLN 3 per share. The dividend yield was 8.8%.

Similarly to the previous years, as per the supervisory institution’s recommendation, dividend should be paid only by the insurance companies that meet specific financial criteria.

At the same time, the dividend payment should be limited to the maximum of 75% of the 2015 profit maintaining the capital requirement coverage ratio after dividend of at least 110%, in accordance with Solvency II. Simultaneously, the supervisory body allowed the payment of dividend from the entire profit generated in 2015, e.g. as long as the capital requirements cover as per Solvency II will stay at or above the level of 150% after the payment of planned dividends.

By the date of preparing this Management Report of PZU Group, the Management Board had not adopted a resolution concerning distribution of profit for 2015.

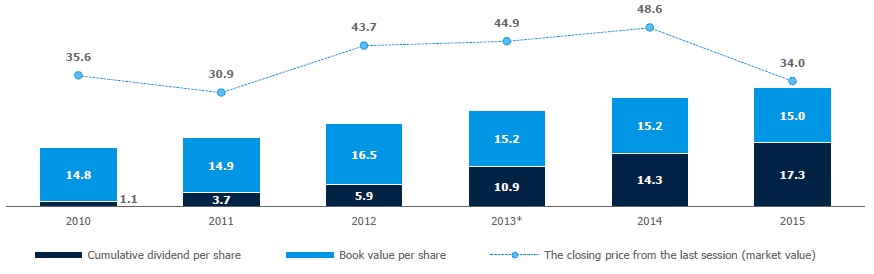

Book value per share and gross accumulated dividend per share ** (PLN)

* dividend from surplus capitals paid in 2013 (PLN 2.00 per share), not included in dividend payout ratio

** historical data was calculated in 1:10 ratio as per stock split

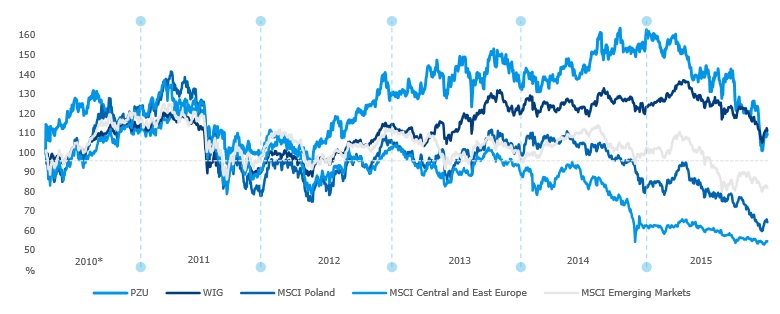

Dynamics of PZU’s share prices in relation to selected stock exchange indexes

** Dividend per share after the exchange of all the shares in a 1:10 ratio.

Source: Reuters..