The operations of PZU companies in the Baltic States and Ukraine are developing stabling, strengthening the Group’s position among the top insurers in these countries.

Lithuanian market

According to the Bank of Lithuania, the value of gross written premium gathered by non-life insurance companies amounted to EUR 409.1 million and was 6.0% higher than in the previous year.

The market dynamics were generated mostly by non-life insurance (composing 20.6% of the market) with written premium growth to 12.4%. Motor insurance, which dominated the premium structure (56.6% market share) also recorded aggregated growth. Motor own damage insurance grew by 8.7% and MTPL insurance grew by 0.5%. The premium growth in motor own damage insurance resulted from both the greater number of policies and the price rise, which followed the price war.

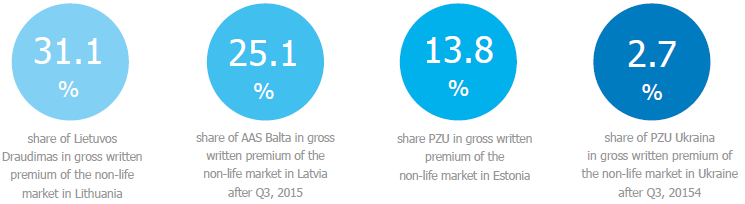

Ten companies were operating in the non-life insurance sector at the end of 2015 (including 10 branches of insurance companies registered in other European states). The largest insurance company in Lithuania in terms of total gross written premiums from non-life insurance remains Lietuvos Draudimas. The 2015 market share of this company was 31.1%. BTA was second with a 13.3% market share and PZU Lithuania was third (12.8% market share). However, PZU Lithuania and Gjensidige hold the combined 19.4% market share, which puts the Gjensidige Group in second place on the non-life insurance market.

The 2015 gross written premium recorded by Lithuanian life insurance companies amounted to EUR 236.0 million, 9.7% higher than in the previous year. Regular (18.5%) and single premium (7.9%) products both presented positive dynamics.

The structure of life insurance was dominated by unit-linked insurance representing 72.1% of the premiums. Traditional life insurance accounted for 20.9% of the written premium.

At the end of 2015, 8 companies were active in the life insurance sector. The Lithuanian life insurance market is highly concentrated. At the end of December 2015, the share of total gross written premiums of the three largest life insurance companies amounted to 62.3%.

Latvian market

At the end of the third quarter of 2015, the Latvian non-life insurance market gathered the written premium of EUR 195.7 million, up by roughly EUR 15 million from the corresponding period of the previous year.

Considering the product structure, the highest market share was held by motor own damage insurance (25.3%) and MTPL insurance (21.2%), as well as property (19.1%) and health (18.9%) insurance. Health insurances present high dynamics – in comparison with the three quarters of last year, the written premium rose by over 14%.

In 2015, 15 insurance companies were operating on domestic non-life insurance market and the 4 biggest ones held the approximate share of 65.3%.

Estonian market

In 2015, the non-life insurance companies and branches of foreign companies of this insurance sector operating in Estonia recorded a 6.7% growth of the gross written premium from the previous year and gathered the total premium in amount of EUR 278.8 million, EUR 62.0 million or 22.2% of which were acquired by the branches of foreign insurance companies operating in Estonia.

The 2015 structure of non-life insurance was dominated by motor insurance, which accounted for 60.7%, whereby the share of motor own damage insurance held 35.3% and property insurance held 26.3% of the market share.

Nine companies were operating in the non-life insurance sector at the end of 2015 (including 3 branches of foreign insurance companies), 5 of which held the share of 82.6%.

Activities of PZU companies in the Baltic states

From November 2014, PZU Group has been operating on the Lithuanian non-life insurance market through Lietuvos Draudimas, which from May 2015 is the owner of PZU Estonia. The acquisition of Lietuvos Draudimas was conditioned by the sale of PZU Lithuania – the disinvestment took place on 30 September 2015.

Lietuvos Draudimas is the leader of Lithuanian non-life insurance with market share of 31.1%. In 2015, it recorded a growth of the gross written premium by 6.8% compared with the previous year and reached the level of EUR 127.2 million. The greatest growth was recorded in motor (6.9%) and property (5.6%) insurance.

The life insurance activity in Lithuania is carried out by UAB PZU Lietuva Gyvybës Draudimas – “PZU Lithuania Life”. Written premium amounted to EUR 10.3 million, a 16.0% growth from the previous year. The greatest sales growth was recorded endowment insurance, which rose by 22.5% from 2014, and unit-linked insurance (growth by 7.9%).

The share of PZU Lithuania Life in the life insurance market was 4.4% (up from 4.1% in 2014).

In Latvia, PZU Group conducts business through AAS Balta – the dominating entity on the market – which entered the Group in June 2014 and, subsequently, acquired the PZU Lithuania branch operating on the Latvian market since 2012 (in May 2015). At the end of the third quarter of 2015, the share of both entities in the non-life insurance market in three quarters was 25.1% and the 2015 total gross written premium of both entities was EUR 67.1million.

From May 2015, the entity conducting business in Estonia is a branch of Lietuvos Draudimas and was established through the merger of two entities – the branch of PZU Lithuania, registered in 2012, and the Estonian branch, acquired in 2014, which was operating under the Codan brand. The share in the Estonian non-life insurance market was 13.8%. The acquired written premium was EUR 38.6 million.

Ukrainian market

In 2015, the Ukrainian insurance market recorded growth. The gross written premiums on the non-life insurance market in three quarters of 2015 was UAH 20.2 billion and was higher by 29.7% than in the corresponding period of the previous year. This growth resulted mainly from the raise of insurance sums, which resulted from the devaluation of the local currency and rising inflation, as well as the statutory raise of compulsory insurance rates. Motor insurance, which hold a 28.2% share in the non-life insurance market, recorded increase in premium of 21.8%, including the growth of the Green Card product by 76.4%.

Life insurance companies collected UAH 1.5 billion gross written premiums in three quarters of 2015, slightly up (by 0.2%) from three quarters of the previous year.

On one hand, the Ukrainian insurance market is fragmented, as it was composed of 368 insurance companies as at September 2015 (of which 50 were providing life insurance). On the other hand, the TOP 100 non-life insurance companies generated 96.3% of the entire market’s gross written premium and the TOP 20 life insurance companies generated 98.9% of the written premium.

In 2015, much like in the previous year, the Ukrainian insurance market experienced difficult conditions associated with the state’s weakened economy, the armed conflict in the east, devaluation processes, decline of the bank system liquidity, and low client activeness. The market continued to present a high level of acquisition expenses, problems with preservation of current liquidity of some insurance companies and reduced confidence among natural persons. The aforementioned events resulted in client reorientation towards companies with western capital share, a process started in 2014 – if the previous key factor in choosing an insurer was the price, the current one is credibility and solvency.

PZU Group conducts its insurance business on the Ukrainian market through two companies: PZU Ukraine (in terms of non-life insurance) – “PZU Ukraine” and PrJSC IC PZU Ukraine Life (life insurance) – “PZU Ukraine Life”. In addition, LLC SOS Services Ukraine performs assistance functions.

In 2015, the total gross value of PZU Group’s gross written premiums in non-life insurance in the Ukraine amounted to UAH 798.9 million, i.e. it was 58.5% higher than in the previous year. This increase arose from both the growth in the premium obtained through external entities (banks and travel agencies) and through its own distribution channels. Motor insurance, Green Card insurance, tourism insurance, and corporate property insurance played a particularly important role in the growth in written premiums.

During three quarters of 2015, PZU Ukraine had obtained 2.7% (growth of 0.5 p.p. in relation to three quarters of 2014) of the gross written premium on the Ukrainian non-life insurance sector, which gave it seventh place on the market. Meanwhile, the leader’s share was 5.3%.

The written premium collected by PZU Ukraine Life in 2015 amounted to UAH 177.8 million and was 15.2% higher than in 2014. This growth was achieved primarily in the bancassurance and brokerage channel, mainly thanks to sales of life and endowment insurance.

On the life insurance market, PZU Ukraine Life held fourth place after three quarters of 2015, with a market share of 8.6% (1.3 p.p. growth in comparison with the previous year). The leader’s share was 18.6%.

It should also be noted that the written premium in the functional currency for both companies was lower than last year under the conditions of strong currency depreciation. In 2015, the premium of PZU Group in Ukraine was PLN 168.2 million, down by 3.1% from the previous year.

Due to the uncertain political and economic situations in the country, the management boards of PZU Ukraine and PZU Ukraine Life decided to take the following risk reduction measures:

- outside of standard exceptions (war, terrorism, etc.) insurance activity does not cover illegal actions of third parties. Furthermore, conclusion and extension of non-life insurance for natural persons and legal entities, including mortgaged property where the insurance falls within the territory of the Donetsk and Luhansk regions, is temporarily suspended; the same applies to shipping and carrier liability insurance if the transport route runs through the aforementioned regions;

- regional branches in Crimea and the Donetsk and Luhansk regions were closed;

- some of the financial assets were transferred to selected banks operating in Ukraine. The selected banks had to have a dominating foreign shareholder and state-owned banks had to meet the criteria presented in the internal regulations of PZU Group.

The PZU Management Board is constantly monitoring the situation in Ukraine in cooperation with the management boards of its Ukrainian companies. Control mechanisms and response scenarios to market changes have been prepared. PZU does not intend to withdraw from the Ukrainian market.

The Management Board of PZU monitors the situation in Ukraine in cooperation with the management boards of the Ukrainian companies. Controlling mechanisms and scenarios of reaction to market changes have been prepared. PZU has no intention of withdrawing from the Ukrainian market. As at the signing date of this activity report, the Management Board of PZU assumes that the companies will continue to operate according to the accepted premises. Nevertheless, the current economic instability in Ukraine may have negative consequences on the financial situation and results of the Ukrainian companies in a way which cannot be predicted with credibility at this time.