Gross written premium in 2015 was PLN 18,359.0 million compared to PLN 16,884.6 million in the previous year signifying growth of 8.7%.

Premiums

Gross written premiums in 2015 amounted to PLN 18,359.0 million compared to PLN 16,884.6 million last year, which means an increase by 8.7%. Within particular segment, the following trends were recorded:

- increase by PLN 652.0 million in written premium collected by foreign companies compared to 2014, including mainly due to premium gathered by entities purchased in 2014;

- higher sales in mass-client segment by PLN 749.5 million (excluding premium between segments) compared to 2014, mainly within motor insurance due to the sales volume of PZU and as a result of Link4 acquisition, as well as insurance of financial losses (commencement of long-term cooperation with new client on the basis of obligatory amount inward reinsurance agreement);

- sales growth in group and individually continued insurance segment – regular premium higher by PLN 149.6 million, mainly due to development of protection insurance sector (a rise in the average premium and higher number of insured) and collection of premium in medical insurance (new clients);

- premium in corporate client segment lower by PLN 42.3 million compared to 2014 (excluding premium between segments), including mainly in TPL insurance as a result in finalization of several large tender procedures in December 2014 (with no impact on net earned premium in 2014), partially offset by high written premium in motor own damage insurance due to a higher number of insurance policies;

- in individual insurance segment, premium lower by PLN 34.4 million compared to the previous year, mainly investment products in bancassurance channel.

Revenue from commissions and fees

Fees and commission revenue in 2015 contributed PLN 242.8 million to PZU Group’s result, which is 30.8% lower than in the previous year. Fee and commission revenue comprised mainly:

- OFE Złota Jesień asset management fee. It amounted to PLN 99.8 million (a drop of 11.0% compared with 2014 as a result of statutory transfer of a portion of the assets of OPFs to the Social Insurance Institution (ZUS) corresponding to 51.5% of the units on the account of every member of OFE PZU);

- income and fees from investment funds and fund management companies of PLN 115.4 million, i.e. PLN 47.5 million more than in the previous year, mainly as a result of the increase in sales of fund units through the external channel;

- commissions from pension insurance handling fees. This amounted to PLN 5.2 million, namely 26.2% of their previous year’s value. The drop associated with the statutory decrease in the rates from 3.5% to 1.75% and the insured making a choice as to the further transfer of their premiums at the new level of 2.92% to OPF concerning future premiums.

Furthermore, the comparison of the revenue balance from commissions and fees with 2014 was affected by a one-off event in the previous year, which saw revenue from liquidation and withdrawal of funds from the additional part of the Guarantee Fund in the amount of PLN 132.3 million, associated with statutory changes in OPF.

Net investment result and interest expense

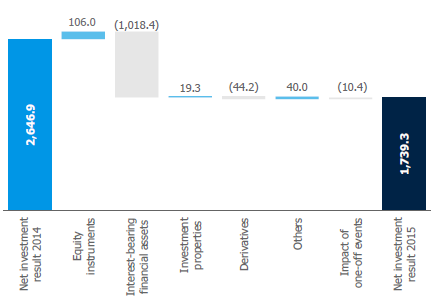

In 2015, PZU Group’s net investment result amounted to PLN 1,739.3 million compared with PLN 2,646.9 million in 2014 (decrease of 34.3%). The following factors had the greatest impact on the decline in the result:

- lower valuation of interest-bearing financial assets as a result of rising yields of Polish treasury bonds in the middle and at the end of the yield curve in 2015, compared to the declines along the entire curve in 2014;

- weaker performance of derivatives purchased mainly for trading purposes aiming at appropriate investment portfolio risk management.

The impact of the above factors was partially balanced by improved results on equity instruments.

The following one-off events had an impact on PZU Group’s net investment result in 2015:

- gross result on the sale of PZU Lithuania in the amount of PLN 165.5 million.

- loss due to the change in fair value of shares purchased within tranche I between the purchase date and the date of control commencement of over Alior Bank, 18 December 2015, amounting to PLN 175.8 million.

Interest expense2 decreased in 2015 by 20.3% as compared to the previous year.

A drop in interest expense was mainly caused by a lower use of sell-buy-back transactions.

As at the end of 2015, the value of PZU Group’s investment portfolio3 amounted to PLN 55,411.2 million compared with PLN 53,958.7 million as at the end of 2014.

Investing activities of PZU Group are conducted in compliance with the statutory requirements, ensuring an appropriate degree of safety, liquidity and profitability; therefore, treasury debt instruments accounted for more than 60% of the investments portfolio, both as at 31 December 2015 and 31 December 2014.

| Insurance segment PLN million, local accounting standards | Gross written premium | ||||

|---|---|---|---|---|---|

| 2015 | 2014 | 2013 | 2012 | 2011 | |

| TOTAL | 18,359 | 16,885 | 16,480 | 16,243 | 15,279 |

| Non-life insurance – Poland (externally written premium) | 9,074 | 8,367 | 8,269 | 8,451 | 8,242 |

| Mass client insurance - Poland | 7,309 | 6,560 | 6,534 | 6,614 | 6,421 |

| MTPL | 2,595 | 2,373 | 2,453 | 2,567 | 2,486 |

| Motor own damage | 1,727 | 1,579 | 1,549 | 1,598 | 1,641 |

| Other products | 2,987 | 2,608 | 2,531 | 2,449 | 2,295 |

| Corporate insurance - Poland | 1,765 | 1,807 | 1,735 | 1,838 | 1,821 |

| MTPL | 367 | 354 | 372 | 394 | 405 |

| Motor own damage | 510 | 461 | 479 | 544 | 645 |

| Other products | 888 | 992 | 885 | 899 | 771 |

| Total life insurance - Poland | 7,923 | 7,808 | 7,745 | 7,454 | 6,752 |

| Group and continued insurance - Poland | 6,689 | 6,539 | 6,415 | 6,364 | 6,179 |

| Individual insurance - Poland | 1,234 | 1,269 | 1,330 | 1,090 | 573 |

| Total non-life insurance – Ukraine and Baltic states | 1,288 | 632 | 388 | 338 | 285 |

| Ukraine non-life insurance | 138 | 133 | 157 | 142 | 121 |

| Baltic states non-life insurance | 1,151 | 499 | 230 | 196 | 164 |

| Total life insurance – Ukraine and Baltic states* | 74 | 78 | 78 | x | x |

| Ukraine life insurance* | 31 | 41 | 47 | x | x |

| Lithuania life insurance* | 43 | 37 | 32 | x | x |

* Consolidated starting 1 January 2013.

Change of the net investment result (PLN million)*

* The line Others of “Net investment result” is presented including foreign exchange differences, also on own debt instruments, which were beforehand presented under the line “Borrowing costs”, as well as including the change in valuation of investment contracts at fair value, which were beforehand presented under the line “Change in valuation of investment contracts”, which was deleted beginning from the current period.

Increased volume of treasury instruments of the debt market resulted from consolidation of Alior Bank portfolio.

Share of investment property declined as a part of portfolio achieved the expected investment horizon and was presented separately in the line “Assets held for sale”.

Interest expense (PLN million)

Money-market transactions were executed in order to boost effectiveness of investment activities and achieve additional margins.

PZU Group’s investment activities in 2015 concentrated on continuing the realization of the strategy aiming at optimization of investment operations’ profitability by greater diversification of investment portfolio.

Investment portfolio structure (PLN million)**

** Derivative instruments based on interest rates, currency exchange rates and prices of securities are presented in the category Debt market instruments – treasury, Money market instruments, and Quoted and non-quoted equity instruments.

Other operating income and operating expenses result

In 2015, the balance of other net operating income and expenses was negative and amounted to PLN 418.8 million compared with the also negative balance for 2014 of PLN 370.1 million. The following factors had an impact on this result:

- higher costs of intangible asset amortization identified as the result of the 2014 acquisition of insurance and medical companies with value of PLN 161.1 million (PLN 87.8 million in 2014).

- greater expenses associated with preventive activity (PLN 92.4 million in 2015 compared to PLN 68.2 million in the previous year);

2 “Interest expense” is presented excluding foreign exchange differences, also on own debt securities, which are currently presented in net investment result as Others, but including change in valuation of investment contracts at amortized cost, which were beforehand presented under the line “Change in valuation of investment contracts”, which was deleted beginning from the current period.

3 The investment portfolio comprises financial assets (including investment products, excluding credit receivables from clients), investment property, negative measurement of derivative instruments, and liabilities from sell-buy-back transactions.