In 2015 the PZU Group generated a gross profit of PLN 2,943.7 million compared to PLN 3,691.7 million in the prior year. The net profit attributable to shareholders in the parent company was PLN 2,342.4 million compared to PLN 2,967.7 million in 2014.

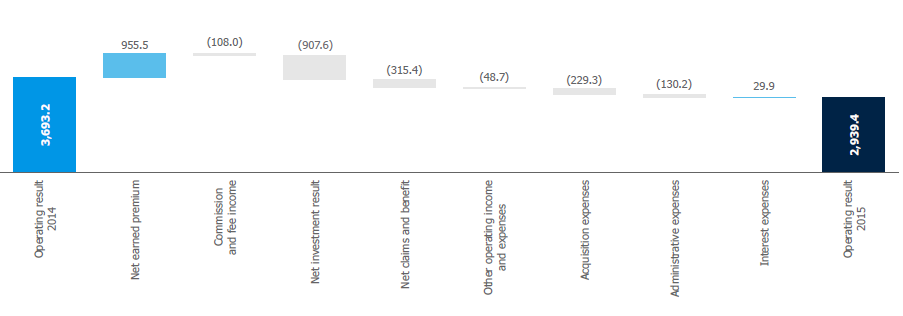

With the exception of one-off events1, the net result declined by 20.2% compared to the previous year. The operating profit for 2015 amounted to PLN 2,939.4 million, down by PLN 753.8 million from the result for 2014.

The main reasons for the change were the following:

- lower result of the mass client insurance segment by PLN 104.8 million, associated mainly with decrease of profitability in motor insurance resulting from the growth of dynamics of reported claims with maintenance of the average claim from the previous year and increase of insurance activity costs;

- growth of PLN 94.5 million in profitability of the corporate insurance segment. Improvement mainly in TPL insurance resulting from declined provisions for claims for damage from previous years;

- drop of PLN 187.1 million in profitability of the group and individually continued insurance segment associated mainly with increased claims ratio of protective products resulting from higher mortality ratio;

- result of the pension insurance segment lower by PLN 122.0 million due to OPF reform;

- drop in net investment result mainly due to lower valuation of interest-bearing financial assets resulting from the yield increase of the Polish treasury bonds.

The following one-off events had an impact on PZU Group’s result in 2015:

- gross result on sale of PZU Lithuania in the amount of PLN 165.5 million.

- loss due to the change in fair value of shares purchased within tranche I between the purchase date and the date of control commencement of over Alior Bank, i.e. 18 December 2015, amounting to PLN 175.8 million.

- the effect of the conversion of long-term insurance contracts into annual renewable contracts in type P group cover at the amount of PLN 75.4 million, i.e. PLN 5.5 million more than in 2014.

2015 saw significant changes, which impacted comparability of the results and the assets and liabilities:

- purchase of Baltic state companies in 2014 (subject to consolidation for the full period in 2015);

- sale of PZU Lithuania in September 2015;

- commencement of the consolidation of Alior Bank. Resulting from this transaction, the total assets rose by roughly PLN 40 billion and the non-controlling interest by PLN 2.3 billion at the end of 2015.

Within particular items of the operating result, PZU Group recorded:

- an increase in the gross written premium to the level of PLN 18,359.0 million compared with the previous year (increase of 8.7%) mainly due to the growth of its foreign operations and the premium collected by Link4. After accounting for the share of reinsurers and the change in provision for unearned premium, the net premium earned amounted to PLN 17,384.9 million, which was 5.8% higher than in 2014.

- lower net investment result, in particular due to the decline in the valuation of debt instruments. Net result on investing activities amounted to PLN 1,739.3 million and was 34.3% lower than in 2014;

- higher amount of claims and benefits. These amounted to PLN 11,857.1 million, i.e. they were 2.7% higher than in 2014. Specifically, there were more claims reported in motor insurance and a higher mortality ratio in protection insurance;

- higher acquisition expenses (by PLN 229.3 million) resulting mainly from the consolidation of the insurance companies acquired in 2014 and growth of direct acquisition costs in the mass client segment;

- growth of administrative expenses to PLN 1,657.9 million from 1,527.7 million in 2014 associated mainly with the costs of foreign companies (mainly the newly acquired ones), which rose by PLN 59.2 million and, concerning insurance activity in Poland, growth of expenses in relation with the development of the Everest Platform (the target policy system for non-life insurance) and other strategic projects aimed to improve customer service by tied agents and develop distribution channels;

- higher negative balance of other operating revenues and expenses in the amount of PLN 418.8 million (negative impact of the change on the gross year-on-year result of PLN 48.7 million) mainly due to the amortization of intangible assets identified as a result of the acquisition of insurance companies

Operating result of PZU Group in 2015 (PLN million)

| Basic amounts from the consolidated profit or loss account | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|

| PLN million | PLN million | PLN million | PLN million | PLN million | |

| Gross written premiums | 18,359 | 16,885 | 16,480 | 16,243 | 15,279 |

| Net earned premiums | 17,385 | 16,429 | 16,249 | 16,005 | 14,891 |

| Revenue from commissions and fees | 243 | 351 | 299 | 237 | 281 |

| Net investment result | 1,739 | 2,647 | 2,479 | 3,613 | 1,735 |

| Net insurance claims | (11,857) | (11,542) | (11,161) | (12,219) | (10,221) |

| Acquisition expenses | (2,376) | (2,147) | (2,016) | (2,000) | (1,962) |

| Administrative expenses | (1,658) | (1,528) | (1,406) | (1,440) | (1,384) |

| Interest expenses | (117) | (147) | (104) | (127) | (158) |

| Other operational revenues and expenses | (419) | (370) | (220) | (31) | (274) |

| Operating profit (loss) | 2,939 | 3,693 | 4,119 | 4,039 | 2,908 |

| Share in net profit (loss) of entities measured using the equity method | 4 | (2) | 1 | - | - |

| Gross profit (loss) | 2,944 | 3,692 | 4,120 | 4,039 | 2,908 |