The real growth in gross domestic product and the improving circumstances on the labor market contributed to the Polish economy being in an upward trend in 2015.

Gross Domestic Product

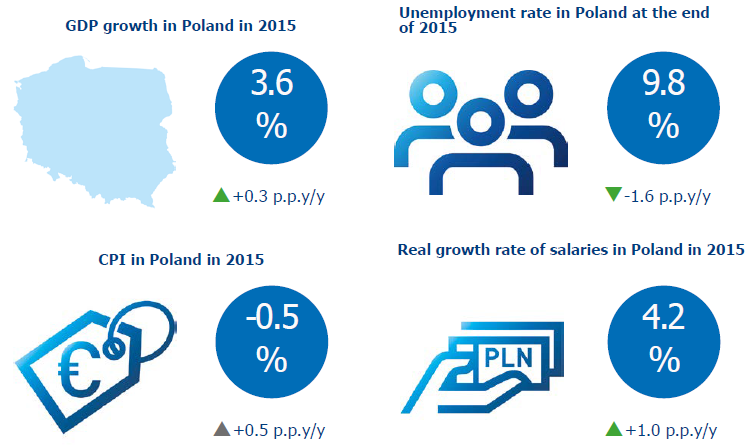

It might be estimated that real GDP growth in 2015 reached 3.6%, compared with 3.3% the year before. The quarterly GDP growth pace remained at the level of 3.3%–3.9% year- on-year.

The improvement in circumstances on the Polish labor market and the persisting real growth in income at a relatively high level contributed to household consumption growth accelerating to 3.1% compared to 2.6% in 2014.

The improvement in circumstances on the Polish labor market and the persisting real growth in income at a relatively high level contributed to household consumption growth accelerating to 3.1% compared to 2.6% in 2014. Domestic demand continued to be the key factor contributing to the economic growth, even though it grew less rapidly than in 2014 (3.3% vs. 4.9%). Improved situation on the labor market, as well as relatively stable real remuneration growth accelerated the dynamics of household consumption to 3.1%, compared with 2.6% in 2014. Savings increased as well. The pace of households consumption growth was exceptionally stable in 2015. The public consumption growth slightly decreased and reached 3.5% versus 4.9% in 2014. In 2015, growth of investment in tangible assets was lower than in the previous year 6.1% compared with 9.8%. Good financial condition of enterprises along with steady economic growth, relatively stable capacity utilization level, high availability and low cost of credit jointly created favorable conditions for investment growth. On the other hand, the uncertainty of demand forecasts and increased volatility in the financial markets induced the companies to remain prudent. At the same time, weakened public investment dynamics may have resulted from entering in a transitory period between two European Union financial perspectives, i.e. for the years 2007–2013 and the years 2014–2020. Unlike in 2014, the change in inventories adversely affected domestic demand and GDP dynamics in 2015.

In 2015 export grew slightly faster than import. As a result, the impact of net export on GDP growth in 2015 was only slightly positive (0.4 p.p.), whereas in 2014 the net export decreased the real GDP growth by 1.5 percentage point.

Composition of GDP growth in Q1 2011 - Q4 2015

The labor market and consumption

Favorable tendencies were observed on the labor market in 2015. The recorded unemployment rate systematically dropped to reach the lowest level since the end of 2008 (9.8% in December compared with 11.4% at the end of 2014.) In 2015, the average monthly employment in the enterprise sector grew by nearly 77 thousand people and its annual dynamics reached 1.4% year-on-year in December 2015 compared with 1.1% year-on-year at the end of 2014.

Under the circumstances of deflation, the pressure on salary increases remained limited. The average monthly salary in the enterprise sector grew in 2015 by 3.2%, the same as the year before. However, due to the dropping consumer price index (CPI), the real salary increase was the highest since 2008. Taking the price changes into account, the average monthly salary in the enterprise sector was 4.2% in 2015 in comparison with 3.2% the year before. Similarly to 2014, salary in the enterprise sector in 2015 grew faster than in the public sector. The average monthly real dynamics of the remuneration fund in this sector in 2015 was on average 5.6% year-on-year and was the highest in 7 years. The real growth of disposable gross income was also considerably larger than in 2014. The consumer sentiment condition indicators also systematically improved. The Consumer Confidence Index published by the Polish Statistical Office (GUS) was the highest since 2008.

The improving financial situation of households and more favorable labor market contributed to a growing consumption and savings of households. The individual consumption dynamics accelerated in 2015 to 3.1% compared with 2.6% the year before.

Inflation, monetary policy and interest rates

In 2015,the yearly average consumer prices (CPI) were lower by 0.9% annually. After hitting the minimum in February (-1.6% year-on-year), the annual CPI was slowly rising to reach -0.5% year-on-year at the end of the year.

Decrease in consumer prices resulted mainly from global processes – global prices of crude oil and other resources strongly dropped, food prices remained low, and so did the inflation level in the countries being Poland’s key trade partners. At the same time, no demand pressure on price growth was observed in Poland, while production price decrease and limited remuneration pressure continued. Net inflation (CPI excluding food and energy prices) amounted in 2015 to an annual average of only 0.3% compared with 0.6% in 2014.

In such conditions, in March 2015 the Monetary Policy Council lowered interest rates by 50 bps, including the reference rate, which was decreased to 1.5%. The decision was justified with prolonged deflation and higher risk of inflation remaining significantly below the target in the medium term. The Monetary Policy Council also indicated that the process of monetary policy easing had been completed. No changes in interest rates were introduced till the end of the year. As per the Monetary Policy Council assessed in December 2015, leaving the interest rates at the same level contributed to maintaining the sustainable growth and macroeconomic balance of the Polish economy.

Public finance

Originally, the 2015 budget provided for a deficit of PLN 46.08 billion. In December, the original budget was amended to increase the deficit planned for 2015 to PLN 49.98 billion. This amount is much higher than PLN 29.98 billion recorded in 2014.

Poland had no difficulties in acquiring market financing. At the end of 2015, approximately 20% of borrowing needs planned for 2016 had been financed.