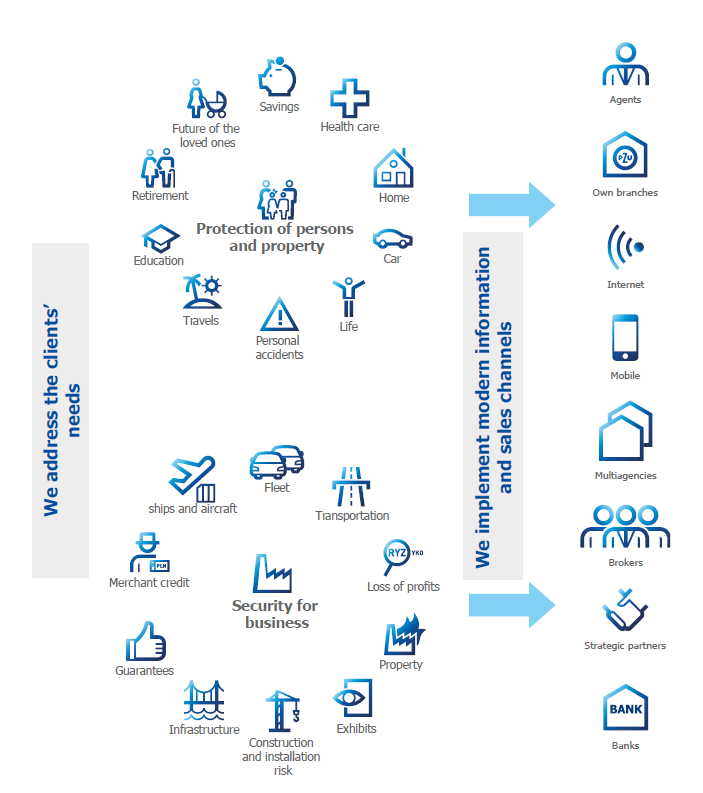

PZU offers a wide range of non-life insurance products in all insurance groups. PZU’s product range encompassed more than 200 insurance products at the end of 2015.

We ensure peace of mind and financial security to our clients

Market situation

Motor insurance is the most important group of products offered by PZU, both in terms of the number of valid insurance contracts, as well as the gross written premiums. The non-life insurance market in Poland measured by the gross written premium grew by an annual average of 3.7% over the past 5 years. The non-life insurance market in three quarters of 2015 increased by a total of PLN 1 016.3 million (+3.9%).

The growth of sales of accident and illness insurance (by PLN 266.4 million, +13.3% year-on-year, 126.9 million of which concerns direct business) and motor own damage insurance (by PLN 288,3 million, +5.5%, 195.4 million of which concerns direct business) mainly as a consequence of average premium growth, had the greatest impact on the premium growth.

Gross written premium of non-life insurance companies in Poland (millions of PLN)

Source: PFSA (www.knf.gov.pl). Quarterly Bulletin. Insurance Market 4/2015. Quarterly Bulletin. Insurance Market 4/2014, Insurance Market 4/2013, Insurance Market 4/2012, Insurance Market 4/2011, Insurance Market 4/2010.

Furthermore, there was growth recorded in sales of TPL insurance (by PLN 172.7 million, +8.6%, PLN 93.9 million of which concerns direct business) and property insurance (by PLN 223.1 million, +3.9%, including a PLN 193.1 million growth on indirect business).

The drop in premiums was most visible in insurance of financial losses (drop by PLN 165.3 million, -12.8%, PLN 414.6 million of which concerns direct business), credit and guarantee insurance (drop by PLN 90.8 million, -10.6%, PLN 82.8 million of which concerns direct business, as well as marine, aviation, and transport insurance (drop by PLN 77.8 million, -21.9%, PLN 65.6 million of which concerns direct business).

Non-life insurance companies – share in gross written premium in 2015 (%)

Capital groups: Allianz – Allianz, Euler Hermes; Ergo Hestia – Ergo Hestia, MTU; Talanx – Warta, Europa, HDI; VIG – Compensa, Benefia, Inter-Risk

Source: PFSA Quarterly Bulletin. Insurance market 4/2015

The whole of the non-life insurance market in 2015 generated a net profit of PLN 2.7 billion (drop by 28.5% compared with the same period of the previous year).

The technical result of the non-life insurance market dropped by PLN 441,1 million, i.e. by 56.2% to the level of PLN 344.5 million. This change was affected to the greatest extent by the drop of the technical result in MTPL insurance (PLN -250.1 million) as a result of the ongoing pricing competition.

Non-life insurance market - gross written premium (PLN million)

| 2015 | 2014 | |||||

|---|---|---|---|---|---|---|

| PZU* | Market | Market without PZU | PZU | Market | Market without PZU | |

| Own Damage | 2.263 | 5.568 | 3.305 | 2.044 | 5.280 | 3.236 |

| MTPL | 3.145 | 8.341 | 5.196 | 2.739 | 8.117 | 5.378 |

| Other | 3.942 | 13.367 | 9.424 | 3.617 | 12.863 | 9.246 |

| TOTAL | 9.351 | 27.276 | 17.925 | 8.401 | 26.260 | 17.859 |

Source: PFSA (www.knf.gov.pl). Quarterly Bulletin. Insurance Market 3/2015, Insurance Market 3/2014

*including Link4, which contributed to the Group’s result from the moment of acquisition, i.e. 15 September 2014

Low profitability in motor insurance in 2015 may be compared to the 2010 results.

The drop of the technical result in MTPL insurance resulted mainly from the lower earned premium (PLN -487.3 million,i.e. -6.7%), while the drop of the result in the motor own damage group stemmed mainly from the higher amount of benefits and claims (+PLN 397.3 million, i.e. +11.6%) and costs of insurance activity (+PLN 57.0 million, i.e. +4.3%).

At the same time, there was a drop in profitability in the group of insurance for damage caused by forces of nature (PLN -81.4 million on direct business) and casco insurance for maritime and inland navigation (PLN -30.2 million on direct business).

The value of investments of non-life insurance companies at the end of 2015 (excluding subsidiary investments) was PLN 52.0 billion and rose by 2.6% from the end of 2014. The instruments issued or guaranteed by the State Treasury and local authorities composed 49.1% of the aforementioned investment portfolio.

Non-life insurance companies, on aggregate, estimated the value of net technical provisions at PLN 41.5 billion, which represented an increase of 4.2% compared with the end of 2014.

Activities of PZU

Within PZU Group, activities on the non-life insurance market in Poland are conducted by the parent company in the Group, i.e. PZU. Furthermore, non-life products are offered by Link4 and, since November 2015, also by Polski Zakład Ubezpieczeń Wzajemnych (TUW PZUW).

Over the past years, PZU has been controlling approximately 1/3 of the non-life insurance market. In 2015, PZU had a 34.3%1 share in the non-life insurance market compared with 33.1% in 2014.

PZU had a strong market position in motor insurance (with a share of 38.2%1). The share was 41.0%1 for motor own damage insurance and 36.4%1 for MTPL.

In 2015, the share of PZU’s technical result in the market’s technical result was 180.3%, which, along with the market share of 34.3%, confirms the high profitability of PZU insurance.

PZU offers a wide range of non-life insurance products in all insurance groups. At the end of 2015, PZU’s offer included over 200 insurance products. Motor insurance is the largest group of products offered by PZU, both in terms of the number of insurance contracts and gross written premium.

1 PZU share calculated with consideration of inward reinsurance of PZU towards Link4

Non-life insurance market – technical result (PLN million)

| Technical results | 2015 | 2014 | ||||

|---|---|---|---|---|---|---|

| PZU* | Market | Market without PZU | PZU | Market | Market without PZU | |

| Own Damage | 12 | (114) | (126) | 159 | 248 | 89 |

| MTPL | (247) | (1.040) | (793) | (304) | (790) | (486) |

| Other | 818 | 1.499 | 681 | 687 | 1.328 | 641 |

| TOTAL | 583 | 344 | (238) | 541 | 786 | 245 |

Source: PFSA (www.knf.gov.pl). Quarterly Bulletin. Insurance Market 3/2015, Insurance Market 3/2014

*including Link4, which contributed to the Group’s result from the moment of acquisition, i.e. 15 September 2014

In the changing conditions and in the face of new demands and interests of the clients, PZU introduced new solutions to its insurance offer in 2015.

In the mass-client insurance:

- PZU Auto Ochrona Prawna (PAOP, PZU Car Legal Protection), under which PZU organizes or covers the costs of protection of the insured party and immediate family’s legal interests. PAOP guarantees legal consulting, legal representation, coverage of court costs in cases associated with vehicle possession, including vehicle traffic and use. The insurance comes in two options: Komfort and Super (Comfort and Super);

- PZU Dom (PZU Home) home insurance was made more attractive by introducing additional Legal Protection insurance. Thanks to the new solution, clients received actual legal assistance for themselves and their relatives in the instances when the tenant refuses to pay the rent, the home improvement crew fails to meet the contract, the seller fails to deliver the goods ordered online, and many others. Just like the Auto product, the insurance comes in two options: Komfort and Super (Comfort and Super);

In the Corporate Client Division, 2015 was the first year to witness the operation of a new approach to sales and management, which is associated with the strategic project of transforming the corporate sales model. The implementation of the new solution is planned to translate into development of corporate business in the key areas.

A new product was introduced in the corporate client segment – guarantee of payment for shares purchased as a result of a squeeze-out – this offer is mainly for entities with a strong financial and market position. The first such guarantee covers PLN 700 million.

In the scope of financial insurance for corporate clients, PZU took part in large Polish modernization projects, including the ones in power engineering and infrastructure, by issuing security guarantees.

A platform was launched to handle financial liability insurance - PZU Gepard. The platform is designed for corporations and small and medium enterprises insuring financial liabilities at PZU.

PZU Group cooperated with 8 banks and 6 strategic partners in the scope of protective property insurance in 2015. The partners of PZU Group are the leaders in their fields and have customer bases with great potential to expand the offer with successive bancassurance and strategic partnership products:

- the cooperation in the scope of strategic partnerships concerned mainly the companies operating in telecommunications and energy, which were used to offer insurance of electronic equipment and assistance services;

- the sales of protective non-life insurance in the scope of the bancassurance channel covered mainly the insurance of buildings, structures, residences, and insurance dedicated for payment cards.

In 2015, PZU collected gross written premiums of PLN 8,858.0 million, which was 7.2% more than in the previous year. At the same time, its structure slightly changed:

- value of MTPL insurance was PLN 2,824.4 million, which was 6.6% higher than in the previous year. It composed 31.9% of the entire portfolio, i.e. their share dropped by 0.2 p.p. from 2014. The higher sales resulted mainly from conclusion of new inward reinsurance agreements with PZU Group subordinates, including the ones newly acquired in the Baltic states and Link4;

- PZU collected PLN 2,167.7 million from motor own damage insurance premiums, which was 7.5% more than in the previous year. This represented 24.5% of the overall portfolio, i.e. its share remained at a similar level to that of the previous year.

- share of gross premiums from non-motor insurance in total premium increased to 43.6% (as compared with 43.5% in 2014). The written premium value rose by 7.5% year-on- year to PLN 3,865.9 million.

In 2015, PZU paid gross claims and benefits amounting to PLN 5 135.2 million, which was 16.0% more than in the previous year.

Furthermore, the comparability of year-on-year results is influenced by the recognition of the IBNR provision for compensation from pain and suffering for damages occurred before 2008.

In 2015, PZU generated a net profit of PLN 2,248.5 million, of which PLN 1,690.2 million related to the dividend from PZU Życie.

PZU’s gross written premium (PLN million)

Activities of Link4

In the scope of PZU Group’s development strategy aimed at strengthening PZU’s position in Poland and at international expansion, PZU signed the agreement for the acquisition of Link4 shares on 17 April 2014. This transaction was finalized on 15 September 2014, and the transaction was ultimately settled on 11 March 2015. As the purchaser, PZU paid the total price of EUR 91.8 million.

Link4 is the leader of the Polish direct insurance market and offers a wide range of non-life insurance, which covers motor insurance, property insurance, personal insurance, and TPL insurance.

Motor insurance is the most important group of products offered by Link4, both in terms of the number of binding insurance contracts and the premium share in the total gross written premiums.

Motor insurance is the most important group of products offered by PZU, both in terms of the number of valid insurance contracts, as well as the gross written premiums.

In 2015, there were many changes made to the Link4 product offer, which were intended to adapt the offer to the changing market demands and trends. Link4 focuses on innovative solutions. Some of the 2015 initiatives are listed below:

- introduction of solutions promoting safe driving and ecodriving for individual clients and mini fleets. The company established cooperation with a provider of GPS navigation system in mobile phones and (during the promotional period) added a one-year license for a navigation system and section „Safe Driving with Link4”) to the purchased policy. The purpose of the project is to create the future potential for lowering policy prices because of safe driving;

- a new online insurance payment product was developed and will be tested in the first quarter of 2016. The company will realize this project with the innovative internet platform supporting online sales. For this purpose, the company created a new brand, Link4Pay;

- company also introduces graphic general insurance conditions for easier understanding. The document is available for download at www.link4.pl.

In 2015, the decision was made to discontinue sales of insurance offered to the corporate clients. Taking into consideration a much greater experience in quoting and the amount of regulatory capital, the insurance for corporate clients will be offered by the PZU Brand.

In 2015, Link4 collected gross written premiums of PLN 493.2 million, most of which concerned motor insurance, respectively:

- value of MTPL insurance was PLN 320.9 million, which constitutes 65.1% of the entire portfolio;

- value of the motor own damage insurance premium was PLN 95.8 million, which composes 19.4% of the entire insurance portfolio.

Activities of TUW PZUW

On 30 November 2015, PFSA approved PZU’s establishment of a Mutual Insurance Company under the name of Polski Zakład Ubezpieczeń Wzajemnych (TUW PZUW). The hospitals cooperating under the TUW model will be able to distribute the risk in the scope of mutual relations adapted to the specifics of a given group of medical entities, which will reduce the costs of insurance premium. As a founding member of TUW PZUW, PZU will provide hospitals - TUW participants – support in active risk management and development of recommendations concerning reduction of suffered risk by means such as extended cooperation in the scope of Medical Risk Assessment (MRA).

Factors, including risks and dangers, which will impact the activities in the non-life insurance sector in 2016

Apart from events of a catastrophic nature (such as floods, drought and spring frost), the main factors which can affect the situation of the non-life insurance sector in 2016 include:

- possible slowdown of economic growth in Poland resulting from deteriorating external conditions. In consequence, the worse financial standing of households can lead to a decline in sales of motor policies (as a result of lower new car sales), lower sales of mortgages and the related mortgage related insurance, as well as lower demand for other property insurance. The poorer financial standing of businesses can result in a growth in credit risk and an increase in the level of claims in the financial insurance portfolio.

- the reduction in the development of mortgage campaigns as a result of the introduced asset tax and stricter requirements of Recommendation S on good practices regarding the management of credit exposures collateralized with mortgages;

- decisions of supreme courts in the scope of monetary compensation to the closest relative from the TPL insurance of owners of motor vehicles for damage resulting from the violation of his or her personal welfare even if the damage took place before 3 August 2008;

- potential raise of claims handling costs resulting from the implementation of further recommendations concerning claims handling by the PFSA;

- raise of spare parts prices with effect on claims handling costs resulting from the successive drop of PLN against the euro;

- implementation of the Solvency II requirements based on risk evaluation from January 2016 may change the operating model of selected areas of the insurance companies on the market (e.g. the tariff policy);

- further regulations or financial burdens imposed on insurers – e.g. a possible reinstatement of so-called “Religa tax” (i.e. compulsory fee payable to NFZ from every MTPL policy).