Several market segments have been distinguished to manage the PZU Group. They include corporate insurance, mass insurance, pension insurance, Ukraine and the Baltic States.

For management purposes, PZU Group has been divided into the following industry segments:

- corporate insurance (non-life) - this segment encompasses a wide range of non-life insurance, general liability and motor insurance, which are adapted to client needs and, with individually valued risks, offered by PZU and Link4 to large business entities.

- mass insurance (non-life) – composed of non-life, accident, TPL, and motor insurance products. PZU and Link4 provide the insurance to individuals and entities from the SME sector;

- life insurance: group and individual continued - PZU Życie offers this insurance to groups of employees and other formal groups (e.g. trade unions). It includes the following types of insurance: protection, investment (which, however, are not investment contracts) and health insurance;

- individual life insurance – PZU Życie offers this insurance to individual clients. The insurance contract relates to a specific insured, subject to the assessment of the individual risk. This group comprises protection, investment (other than investment contracts) and health insurance products. Individuals who have a legal relationship with the policyholder (for instance an employer or a trade union) may enroll in the insurance; and individually continued insurance in which the policyholder acquired the right to individual continuation during the group phase.

- investments – reporting in accordance with PAS – comprises investment activity conducted with PZU Group’s own funds defined as the surplus of investments over technical provisions in the insurance companies within PZU Group with their registered offices in Poland (PZU, Link4 and PZU Życie) increased by the surplus of income exceeding the risk-free rate from investments matching the value of technical provisions of PZU, Link4 and PZU Życie in insurance products, i.e. the surplus of investment income of PZU, Link4 and PZU Życie over the income allocated to insurance segments according to transfer prices. Additionally, the Investment segment includes income earned on other excess funds in PZU Group;

- pension insurance - activity conducted by PTE PZU.

- Ukraine segment - includes both non-life and life insurance;

- Baltic states segment - non-life and life insurance products provided in Lithuania, Latvia, and Estonia;

- investment contracts - including PZU Życie products, which do not transfer significant insurance risk and do not meet the definition of an insurance contract. They include some products with a guaranteed rate of return and some unit-linked products.

- other - this encompasses consolidated entities not allocated to any of the segments above.

Corporate insurance

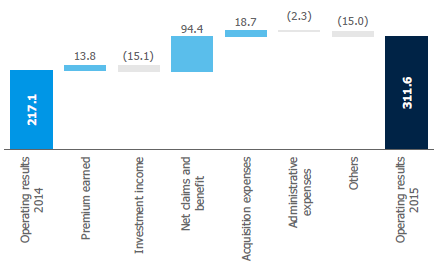

In 2015, the corporate insurance segment (composed of PZU and Link4) earned the operating profit of PLN 311.6 million, which is 43.5% more than in corresponding period of the previous year.

The commencement of Link4 consolidation in September 2014 entailed the growth of particular items in the 2015 operating result in comparison with the corresponding period of the previous year.

The following factors primarily had a key impact on this segment result in 2015:

- 0.9% growth of the net earned premium despite the slight decrease in the gross written premium by 0.4% compared with 2014. Lower sales were recorded mainly in the TPL insurance group resulting in finalization of several large tenders conducted by medical entities in the December 2014 (with no effect on the premium earned in 2014) and the motor own damage insurance group for rail vehicles and guarantees. Decrease in the written premium was partially offset by the increase in sales of motor own damage insurance as a result of a higher number of insurance policies and in the group of insurance against fire and damage to property resulting from the acquiring several strategic clients and entering contracts for the period longer than one year;

- 9.8% decline in net claims and benefits in comparison with the corresponding period of 2014, which, considering a 0.9% increase of the net premium earned, means that the loss ratio decreased by 7.0 p.p., to the level of 58.9%. The decline was recorded mainly in TPL insurance (lower level of provisions for previous years claims) and insurance for damage caused by forces of nature (lower claims rate). The effect is partially offset by the increased claims and benefits in motor insurance as a result of the higher average claim payment and higher number of reported claims;

- 11% decline in the investment income allocated to the segment at transfer prices to PLN 121.4 million, which was caused by the lower market interest rates;

- decline in acquisition expenses by PLN 18.7 million, i.e. 6.1 % compared with 2014, resulting from higher level of deferred acquisition costs partially offset by the increase in commission from inward reinsurance and indirect acquisition costs;

- an increase in administrative expenses to the level of PLN 127.4 million, i.e. 1.9 %, compared with the previous year. The level of expenses in 2015 was influenced by e.g. implementation of changes in client relations management, including mainly implementation of a new model of the corporate insurance sales network.

Operating profit in the corporate segment (PLN million)

Mass client insurance

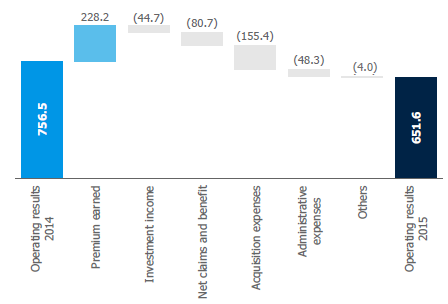

In 2015, the operating profit in the mass client insurance segment amounted to PLN 651.6 million (a 13.9% decrease compared with the prior year).

The commencement of Link4 consolidation in September 2014 entailed the growth of particular items in the 2015 operating result in comparison with the corresponding period of the previous year.

The result was determined by the following factors:

- 3.5% growth of the net earned premium y/y to PLN 6,791.3 million with simultaneous growth of the gross written premium by 14.6% (excluding the premium from the Group’s subsidiaries, +11.4% y/y). Sales growth was recorded mainly in the motor insurance group as result of higher sales of motor insurance offered by PZU and acquisition of Link4 as of 15 September 2014. Higher premium was recorded also in the group of insurance of financial losses (due to long-term cooperation with a new Client under obligatory inward reinsurance agreement) and insurance for damage caused by forces of nature. Moreover, the premium growth was caused also by including Link4 and companies in the Baltic states in the inward reinsurance program (eliminated at the consolidated level);

- 1.8% higher amount of claims and benefits than in 2014. The decline in results from the previous year stemmed mainly from the higher claims and benefits level in motor insurance, which was determined mainly by the high dynamics of claims reported and paid of motor own damage insurance. The adverse events were partially offset by a lower level of claims in property and agricultural insurance (especially regarding claims of mass character); Furthermore, the comparability of the results is influenced by the recognition of the rise of claims provision for compensation from pain and suffering for damage occurred in previous years in the 2014 result.

- 7.9% decline y/y (i.e. PLN 44.7 million) in the investment income allocated to the mass insurance segment at transfer prices, which was caused by the lower market interest rates;

- 12.5% higher acquisition costs compared with the corresponding period of the previous year resulting from higher inward reinsurance commission (effect of the conclusion of inward reinsurance agreements with the Group’s subsidiaries companies) and indirect acquisition costs (including the costs of sales-assisting activity aimed to improve the effectiveness of the sales network). Furthermore, there was a growth of direct acquisition costs, which resulted from the change to the sales channel mix (higher share of the multiagency and dealers channel);

- 7.8% higher administrative expenses in comparison with 2014. This change was due to expansion and initial usage of the Everest Platform (policy system for non-life insurance) and other strategic projects aimed to improve client service by tied agents and develop distribution channels.

Operating profit in the mass segment (PLN million)

Group and individually continued insurance

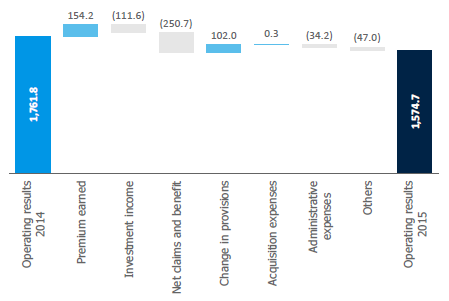

The operating profit of the group and individually continued insurance amounted to PLN 1,574.7 million and was 10.6% lower than in the previous year. This was a result of:

- growth of the gross written premium by PLN 149.6 million (+2.3%) was primarily due to:

- development of group protection insurance (growth of the average premium and number of insured parties, including high level of new sales);

- acquisition of the premium in group health insurance (new clients in ambulatory insurance and sales of medicine product versions);

- upselling of riders and higher sums insured in individually continued products.

The positive effects were partially offset by the decrease in premium in unit-linked insurance, which resulted from the transfer of EPP agreements of PZU’s employees to the EPP operated by TFI PZU;

- lower investment income. In 2015, it amounted to PLN 601.7 million, i.e. dropped by 15.6%, which resulted from the decline of the revenue allocated according to transfer pricing as the effect of lower market interest rates and from the decrease in revenue from unit-linked products as the effect of lower treasury bond prices compared to the rises in the previous year;

- 5.6% higher net insurance claims and benefits. In 2015, they closed at PLN 4,750.1 million. The change resulted mainly from the following:

- increased mortality ratio in protection insurance compared with the previous year, confirmed by the CSO (Central Statistical Office) survey on the entire population and additional growth of the agreement portfolio itself;

- higher endowment payments in short-term endowment products and structured products in the bancassurance channel - maturity dates reached for the subsequent product tranches; no effect on the result – offset by the change to the technical insurance provisions.

- PLN 31.6 million drop in other net technical provisions compared to the PLN 70.3 million provision growth of the previous year. The main cause was the lower growth of provisions in individually continued products – higher mortality ratio (a client’s death entails the need for benefit payment, but simultaneously releases the technical and insurance provision) and higher share among people entering the portfolio following the modification allowing for the creation of lower initial technical and insurance provisions. Furthermore, PZU Życie’s modified these rules from the start of 2016 in the scope of the annual process of establishing the rules for possible indexation of the sum insured by the clients in continued insurance. This had a positive impact on the level of technical provisions in this portfolio. There was also a greater decline of provisions in short-term life and endowment products and structured products in the bancassurance channel compared with the previous year – endowment of the subsequent product tranches in the face of the lack of sales of new contracts. Moreover, the slightly higher rate of conversion of long- term contracts into annual renewable contracts in type P group cover also affected the level of these provisions. As a result, provisions of PLN 75.4 million were released, i.e. PLN 5.5 million more than in 2014;

- acquisition costs similar to those of the previous year. These costs amounted to PLN 356.3 million. Factors determining the level of direct and indirect acquisition costs included high sales of riders to continued protection insurance (agent remuneration, costs of distributing the offers to the clients and associated indirect costs) and increased sales activity in the scope of health products. These factors were offset by the lower acquisition costs in group protection insurance as the effect of the rising focus of the agency network on acquisition of individual protection products;

- 6.3% higher administrative expenses. The growth to PLN 577.2 million was determined mainly by strategic expenses in distribution and operating support. 2015 saw the continuation of several strategic products aimed to build an innovative distribution channel and for other purposes;

- the PLN 47.0 million year-on-year decline in other revenues and expenses was caused by a prevention fund charge (no such cost was recorded in the previous year, eliminated at the level of the consolidated result) and higher costs related to PZU Życie financing the premium (higher promotional sales of additional insurance policies to individually continued insurance).

After excluding the one-off effect related to the conversion of long-term contracts into renewable contracts type P from the segment’s result, the segment’s 2015 operating profit amounted to PLN 1,499.3 million, compared with PLN 1,692.0 million in the corresponding period of 2014 (a 11.4% drop). The main cause of the inferior result is the higher claims ratio of the protection portfolio resulting from higher mortality ratio.

Operating profit of the group and individually continued insurance (PLN million)

Individual insurance

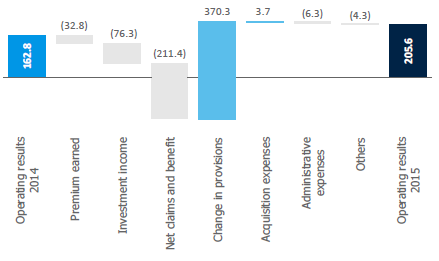

In 2015, the operating result of the individual life insurance segment amounted to PLN 205.6 million, i.e. it was 26.3% higher than in the prior year. The main factors affecting the level of the segment’s operating result were:

- gross written premium drop of PLN 34.4 million (-2.7%) from 2014 resulted from the following:

- lower sales of unit-linked products in cooperation with banks;

- lack of sales in structured and deposit product in cooperation with banks in 2015;

- withdrawal of the Plan na Życie savings product with a protection component and regular premium.

The negative effect was offset by the following:

- record structured product subscriptions in own channel;

- high sales of protection products – resulting from the changes to the commission system and improvement of the offer through introduction of the new Pomoc od Serca additional insurance;

- higher average deposits to IKE accounts;

- introduction of a new unit-linked product into the own channel offer: Cel na Przyszłość.

- lower investment income. Decrease year-on-year by PLN 76.3 million to PLN 250.4 million in the individual insurance segment, mainly in unit-linked products in the bank channel, resulting mainly from the sentiment on the Polish capital market in 2015, which was inferior to that of the previous year. The income allocated according to transfer prices slightly declined;

- 33.1% growth of net insurance claims and benefits. In 2015, they amounted to PLN 850.2 million. This growth resulted from the higher value of surrenders in unit-linked products sold in own channels (PZU’s discontinuation of charging for advanced surrender in the scope of the Plan na Życie product) and the bank channel (year-on-year portfolio growth). The situation on the capital markets was also important in both cases. The next factor included higher endowment payments in structured products in the bancassurance channel (maturity dates reached for the subsequent product tranches) and in term protection products. In the case of investment products, the negative impact of the aforementioned factors on the operating result (with the exception of the lack of charges for advance surrenders) was offset by the appropriate change to the technical provisions;

- the increase in other net technical provisions was lower than in the previous year by PLN 370.3 million. This change was associated mainly with the dropping provision of unit-linked products sold via bancassurance – there was a culmination of three negative effects on the state of provisions, i.e. increased benefit payments, decreased written premium, and negative investment activity result. Additional factors reducing the level of provisions concerned annuity products and included the introduction of uncollected benefit verification and also rise of payments for endowment while simultaneously lacking the sales of structured products in the bancassurance channel in the year. A similar effect was observed in the Plan na Życie savings product with a protection element and regular premium (discontinued sales and withdrawal from charges for advance surrender leading to increased surrenders value);

- acquisition costs lower by 2.9% The drop in the costs to PLN 122.7 million was caused mainly by the withdrawal of the Plan na Życie savings product with a protection component and regular premium;

- administrative expenses increased by PLN 6.3 million in comparison with the previous year. The growth to PLN 59.7 million was determined by strategic expenses in distribution and operating support. The improvements included client service quality by exclusive agents;

- changes in the other revenues and expenses category (expenses higher by PLN 4.3 million) resulting from the prevention fund charges in the current year (no such expense was recorded in the previous year which was eliminated at the consolidated level).

Operating profit of the individual insurance segment (PLN million)

Investments

Income from the investment segment investment activity conducted with PZU Group’s own funds defined as the surplus of investments over technical provisions in the insurance companies within PZU Group with their registered offices in Poland (PZU, Link4 and PZU Życie) increased by the surplus of income exceeding the risk-free rate from investments matching the value of technical provisions of PZU, Link4 and PZU Życie in insurance products, i.e. the surplus of investment income of PZU, Link4 and PZU Życie over the income allocated to insurance segments according to transfer prices. Additionally, the investments segment includes income earned on other excess funds in PZU Group.

The operating profit of the investments segment (external operations only) amounted to PLN 506.2 million and was 12.6% lower than in 2014, mainly due to lower yield of investment portfolio caused mainly by decrease in income on interest-bearing financial assets as a result of increased yield of Polish treasury bonds in the middle and at the end of the yield curve in 2015 compared to the decreases along the entire curve in 2014.

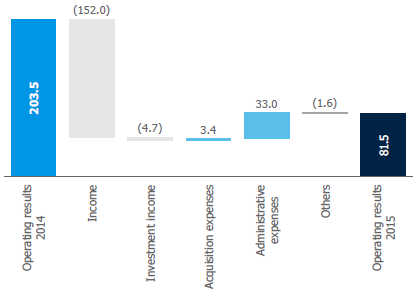

Pension insurance

In 2015, the operating profit of the pension insurance segment amounted to PLN 81.5 million, i.e. it dropped by 60.0% compared with 2014. This was the result of:

- fee and commission revenue, which amounted to PLN 118.5 million, i.e. it dropped by 56.2% from the previous year. This change was the result of:

- the 2014 statutory withdrawal of funds from the additional part of the Guarantee Fund in the amount of PLN 132.3 million;

- decrease of PLN 14.7 million in premium revenue resulting from the discontinuation of premium transfer of members who omitted to fill in the participation declaration during the transfer window to OPFs after 1 August 2014, the reduction of fees from 3.5% to 1.75% on 1 February 2014, and the lack of premiums for the people in the so-called “slider”;

- decrease of PLN 8.1 million in management fee resulting from the statutory transfer of a portion of OPF assets

- to the Social Insurance Institution (ZUS) on 3 February 2014 and the decline in OPF assets during the second half of 2015 as a result of the market situation;

- the net investment revenue amounted to PLN 6.9 million and dropped by PLN 4.7 million due to the financial asset drop;

- the acquisition costs amounted to PLN 2.9 million, i.e. they were 53.6% lower than in the previous year. This resulted from the informational activity conducted by OPF in 2014;

- the administrative expenses amounted to PLN 39.9 million, i.e. were 45.3% lower than in the previous year. In particular, the costs of maintaining pension fund registers declined by PLN 9.3 million due to lowering the fee for the management of the accounts of the members of OFE PZU (first in February 2014, then again in January 2015) and the resignation from the additional compensation for the transfer agent in connection with the fulfillment of assumptions regarding the improvement of the quality of provided services. Fees collected from premiums transferred by the Social Insurance Institution (ZUS) to OPF were lower by PLN 3.3 million as a result of statutory changes. Furthermore, the costs of obligatory additional payments to the Guarantee Fund in the Central Securities Repository of Poland dropped by PLN 20.3 million (mainly as a result of the statutory change of the required level from 0.1% to 0.3% of the net assets of OPF at the end of the first quarter of 2014 and the additional payment of the previous year).

Operating profit in the pension insurance segment (PLN million)

Baltic states

The following changes with considerable impact on data comparability occurred in the Baltic states structure over the years 2014-2015:

- PZU Lithuania was a part of the segment until 30 September 2015;

- in 2014, the segment was expanded to include: AAS Balta (June 2014), Lietuvos Draudimas (November 2014), Estonian branch operating under the Codan brand (November 2014).

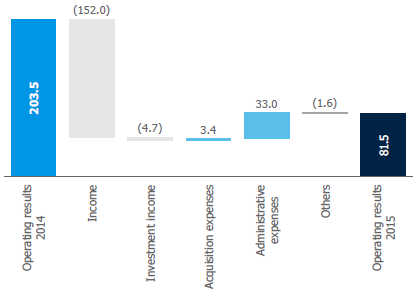

PZU Group generated an operating profit of PLN 43.3 million in the Baltic states in 2015 compared with an operating loss of PLN 17.1 million in the previous year. The result arose from the following factors:

- increase in gross written premium. It amounted to PLN 1,193.9 million, where the companies acquired in 2014 generated the premium of PLN 981.2 million and life insurance recorded a written premium growth of PLN 5.9 million (i.e. 15.9%) from the previous year;

- growth of the investment income. In 2015, the result amounted to PLN 21.8 million, up by 49.0% from the previous year;

- increase in net claims and benefits. They amounted to PLN 686.9 million and were 120.0% higher than in 2014, with the value of claims and benefits of the companies acquired in the previous year amounting to PLN 546.7 million.

In life insurance, the value of claims amounted to PLN 29.3 million, 13.6% up from the previous year.

- increase in acquisition costs. The respective expenses of the segment amounted to PLN 252.8 million, including PLN 202.5 million of acquisition costs incurred by the companies acquired in 2014. The acquisition cost ratio to the net earned premium dropped by 1.4 p.p. to 22.8%;

- increase in administrative expenses. They amounted to PLN 146.4 million, up by 82.5% from the previous year, while the expenses of the newly acquired companies amounted to PLN 111.7 million. At the same time, the administrative expenses ratio amounted to 13.2%, a drop of 3.6 p.p. from the previous year.

- increase in interest-bearing costs. They amounted to PLN 1.8 million and were PLN 1.1 million higher than in the prior year.

Operating profit in Baltic states insurance segment (PLN million)

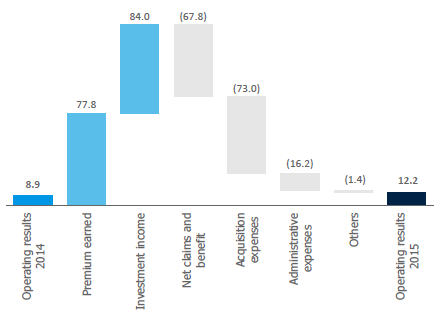

Ukraine

Taking into account the significant depreciation of the Ukrainian currency, the results are presented in the currency used by the companies for reporting purposes.

In 2015, the Ukraine segment earned an operating profit of UAH 12.3 million, compared with UAH 8.9 million in the previous year.

The change of the segment result was caused by:

- increase in the gross written premium. The premium amounted to UAH 976.7 million and increased by 48.4% in comparison with the previous year. The sales of the Green Card (increased rates) and health insurance improved. Taking into account the depreciation of the currency, the written premium showed a reverse trend (a drop of PLN 5.4 million);

- growth of the investment income. This segment earned UAH 239.7 million in this respect, which is 53.9% more than in 2014. The following factors had a positive impact on its level: an increase in the liquid assets base and foreign exchange profits, in particular, in life insurance offered mainly in foreign currencies;

- increase in claims and benefits. They amounted to UAH 425.6 million, i.e. 18.9% higher than in the previous year. The reasons for the increase included the 2.3 p.p. rise of the claims ratio, mainly in property and health products;

- increase in acquisition costs. They amounted to UAH 270.7 million compared with UAH 197.7 million in the prior year. Their level was the result of an increase in the written premium from motor and travel insurance, which are subject to higher commission charges;

- increase in administrative expenses. They amounted to UAH 122.8 million. For comparison purposes, in 2014, the administrative expenses of the segment amounted to UAH 106.7 million. Meanwhile, the administrative cost ratio to the net earned premium remained at the level of 20.7%.

In the reporting currency, the written premium amounted to PLN 168.2 million and was lower by 3.1% compared with the previous year.

Operating profit in Ukraine segment (UAH million)

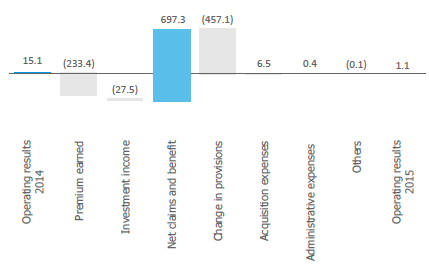

Investment contracts

The consolidated statements present the investment contracts in accordance with the requirements of IAS 39.

The results of investment contracts segment are presented as per the Polish Accounting Standards, which means that, among others, the following items were included: gross written premiums, paid benefits and change in technical provisions. The above categories are eliminated for the purpose of the consolidated results.

PZU Group earned PLN 1.1 million of operating profit compared with PLN 15.1 million in the previous year (drop of 92.5%) on investment contracts, i.e. PZU Życie’s products which do not transfer significant insurance risk and which do not meet the definition of an insurance contract (such as some products with a guaranteed rate of return and some unit- linked products).

The following had an impact on the results of the segment in 2015:

- gross written premium from investment contracts dropped by PLN 233.4 million (-62.3%) from the corresponding period of 2014 to PLN 141.1 million. The main reasons for the changes to the gross written premium included:

- lower sales of short-term endowment products in own channels,

- withdrawal of short-term endowment products in the bancassurance channel.

In both cases, the reason was the low profitability of such agreements for the clients following the drop of market interest rates to unprecedented lows and introduction of the tax on capital revenue for such policies. A positive factor is the year-on-year growth of contribution to accounts observed in IKZE.

- lower investment income. The income was PLN 16.1 million, i.e. 63.1% lower than in the corresponding period of 2014, mainly in the short-term endowment products in own and bancassurance channels, as well as unit-linked in bancassurance channel as the effect of a decline in investments level;

- lower value of net insurance claims and benefits resulting from the considerable drop in endowment payments from short-term endowment products in the bancassurance channel (last year saw the maturity of high-value tranches; considerably lower sales in subsequent periods; no effect on the result – corresponding effect in changes to technical provisions). These amounted to PLN 694.5 million, i.e. they were 50.1% lower than in the prior year;

- lower negative balance of the change in the balance of other technical provisions. This amounted to PLN 558.5 million compared with PLN 1,015.5 million in the prior year. This difference arose mainly from the changes in the portfolio of short-term investment endowments sold through the bancassurance channel, i.e. lower level of endowment combined with the withdrawal of such products from the offer;

- lower acquisition costs. These amounted to PLN 10.0 million, i.e. they were 39.3% lower than in the prior year. This resulted from considerable reduction of sales and declined asset value in unit-linked products of the bancassurance channel (some of the bank’s remuneration is determined by the level of assets);

- lower administrative expenses. These amounted to PLN 9.3 million and declined by 3.8% compared with 2014 – the result of a decrease in the contracts portfolio. The decline is less than proportional because some of the service processes must continue despite failure to generate revenue.

Operating profit in in investment contracts segment (PLN million)

Profitability ratios

In 2015, the return on equity of the dominating entity (PZU) was 18.0%. ROE was 4.6 p.p. lower than in the previous year. The profitability ratios achieved in 2015 by PZU Group exceed the levels achieved by the whole market (according to the data for three quarters of 2015).

| Key profitability ratios of PZU Group | 2015 | 2014 | 2013 | 2012 | 2011 |

| Return on Equity (ROE) – falling to the dominating entity (annualized net profit / average equity) x 100% | 18.0% | 22.6% | 24.1% | 24.1% | 18.3% |

| Return on Equity (ROE) - consolidated (annualized net profit / average equity) x 100% | 16.5% | 22.6% | 24.1% | 24.0% | 18.3% |

| Return on assets (ROA)(annualized net profit / average assets) x 100% | 3.5%* | 4.6% | 5.6% | 6.0% | 4.6% |

| Administrative expenses ratio (administrative expenses / premium earned net of reinsurance) x 100% | 9.5% | 9.3% | 8.7% | 9.0% | 9.3% |

| Return on Sales (net revenue / gross written premium) x 100% | 12.8% | 17.6% | 20.0% | 20.0% | 15.3% |

* excluding Alior Bank

Operating efficiency ratios

One of the basic efficiency and operating measure of an insurance company is the combined ratio (COR) which is calculated for the non-life sector because of its specific nature (Section II).

The combined ratio of PZU Group (for non-life insurance) remains in the last few years at the level which guarantees high profitability. In 2015, the ratio dropped, mainly because of the declined provisions for claims from damage in previous years in PZU’s third-party liability insurance group.

| Operating efficiency ratios | |||||

| 1. Claims ratio gross (Gross claims including change in technical provisions /gross written premium) x 100% | 66.9% | 69.5% | 67.9% | 76.2% | 67.9% |

| 2. Claims ratio net of reinsurance (net claims paid/net premium earned) × 100% | 68.2% | 70.3% | 68.7% | 76.3% | 68.6% |

| 3. Insurance activity costs ratio (Costs of insurance activity/premium earned net of reinsurance ) x 100% | 23.2% | 22.4% | 21.1% | 21.5% | 22.5% |

| 4. Acquisition expenses ratio (cquisition expenses/premium earned net of reinsurance) x 100% | 13.7% | 13.1% | 12.4% | 12.5% | 13.2% |

| 5. Administrative expenses ratio (Administrative expenses/premium earned net of reinsurance) x 100% | 9.5% | 9.3% | 8.7% | 9.0% | 9.3% |

| 6. Combined ratio in non-life insurance (claims + costs of insurance activity)/premium earned net of reinsurance x 100% | 94.6% | 95.7% | 87.8% | 92.8% | 95.3% |

| 7. Operating profit margin in life insurance (operating profit/gross written premium) x 100% | 22.3% | 24.4% | 22.3% | 19.8% | 28.7% |