From its IPO, PZU has distributed dividends totaling almost PLN 15 billion. The dividend paid in 2015 was almost PLN 2.6 billion.

PZU has been quoted on the Warsaw Stock Exchange since 2010. The value of PZU’s first public offer (IPO) PZU was almost PLN 8.1 billion. This was the biggest IPO in the history of the Polish capital market, the biggest offer in Central and Eastern Europe from the beginning of the economic transformation, and the biggest IPO in all of Europe since 2007.

The key shareholder of PZU is still the Ministry of the State Treasury, which represents 34.4% of the share capital.

The State Treasury of the Republic of Poland is PZU’s key shareholder with a 34.4% equity stake.

The remaining shareholders are both Polish and foreign institutional investors (various investment and pension funds) and an extensive group of individual investors (in IPO alone, PZU shares were acquired by over 250 thousand individual investors).

PZU shareholding structure as at 31.12.2015*

*Current report 3/2016

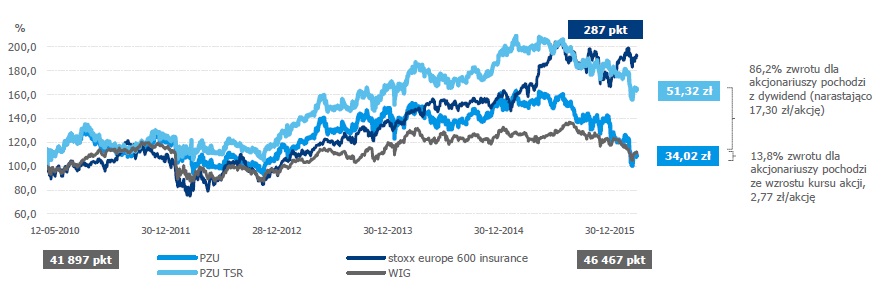

The main ratio serving to measure the effectiveness of the Group’s value building used in communication with the capital market is TSR (Total Shareholder Return). Thanks to the care for generation of high free cash flows, the Group pays high annual dividends, which compose a considerable TSR component, according to the preferences of its shareholders.

In 2015, PZU paid almost PLN 2.6 billion as dividend for the dividend rate of 8.8% (calculated from the share price at the end of 2015, i.e. PLN 34.0). Since its IPO, PZU has already paid out nearly PLN 15 billion in dividends, while the total shareholders return (TSR) from investment in PZU shares amounted to 64.2%.

PZU’s share price listings between the IPO on the Warsaw Stock Exchange (12.05.2010=100) and 31.12.2015

PZU TSR – total shareholder return, including dividend paid by PZU