The PZU Group conducts various activities in insurance and finance. PZU Group companies provide services in life insurance, non-life insurance, health insurance and asset management for customers in an open-end pension fund and mutual funds.

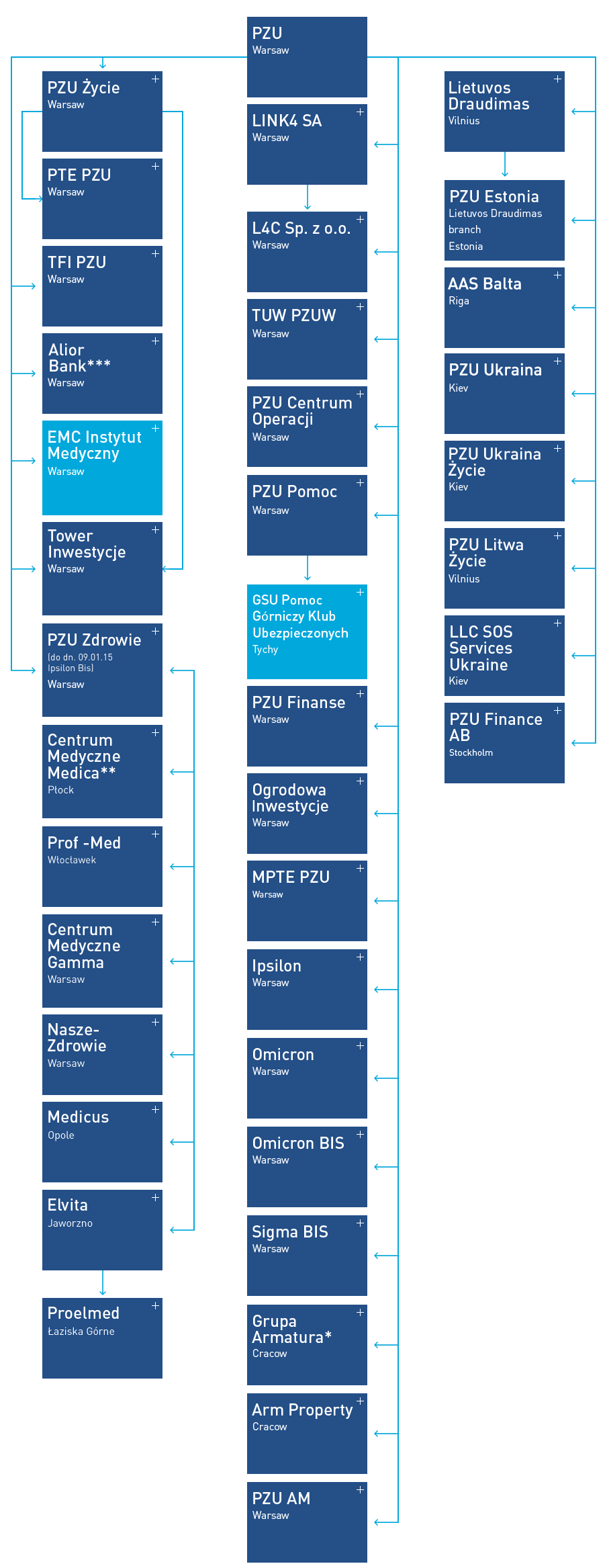

Structure of PZU Group (as at 31 December 2015)

![]() Consolidated companies

Consolidated companies

![]() Affiliates

Affiliates

* Grupa Armatura included the following entities: Armatura Kraków SA, Armatoora SA, Armatura Tower sp. z o.o.(joint venture), Aquaform SA, Aquaform Badprodukte GmbH, Aquaform Ukraine TOW, Aquaform Romania SRL, Morehome.pl sp. z o.o.

** Grupa Centrum Medyczne Medica includes the following entities: Centrum Medyczne Medica Sp. z o.o., Sanatorium Uzdrowiskowe „Krystynka” Sp. z o.o. i Rezo-Medica sp. z o.o.

*** Grupa Alior Bank Medica includes the following entities: Alior Bank SA, Alior Services sp. z o.o. , Centrum Obrotu Wierzytelnościami sp. z o.o., Alior Leasing sp. z o.o., Meritum Services ICB SA , Money Makers SA , New Commerce Services sp. z o.o. The structure does not cover investment funds.

As a parent company, acting through its representatives in supervisory bodies of the companies and casting votes at shareholders’ meetings, PZU influences the process of determining strategic directions, both in the scope of activities and the finances of the entities making up PZU Group.

The companies provide mutual services both under market conditions and based on the internal cost allocation model (in the scope of the Tax Capital Group) thanks to the expertise of selected companies and by taking advantage of the Tax Capital Group.

The following changes took place in the structure of PZU Group in 2015 and until the release of this report:

- On 3 November 2015, PFSA issued its approval to establish a Mutual Insurance Company (Towarzystwo Ubezpieczeń Wzajemnych) under the name of Polski Zakład Ubezpieczeń Wzajemnych (TUW PZUW).

- Pursuant to the agreement concluded on 2 February 2015, PZU Group sold 99.879% of shares in PZU Lithuania to the Norwegian insurance company Gjensidige Forsikring ASA. The transaction was finalized on 30 September 2015, the final price amounted to EUR 66 million. The price will be adjusted by four payments made in 6-month periods, each in the amount representing 1.5% of the capital surplus calculated as the difference between the actual share capital of PZU Lithuania, established according to the requirements of the Bank of Lithuania, and the required capital of PZU Lithuania, calculated in accordance with the provisions of law and the binding regulations of PZU Lithuania. The sale of PZU Lithuania was a necessary condition for acquisition of Lietuvos Draudimas;

- PZU Zdrowie purchased shares in the following medical companies: Nasze Zdrowie (2015), Medicus in Opole (2015), CM Gamma (2015) and CM Cordis (2016); additionally, CM Medica bought REZO-MEDICA (2015).

- in the scope of capital investment, the preliminary agreement for the purchase of Alior Bank shares constituting 25.19% of the Bank’s share capital was signed on 30 May 2015.

- based on the agreement signed on 15 January 2015, PZU subsidiaries Armatura Kraków SA and Armatoora SA (Purchaser) purchased shares in Aquaform SA from Saniku SA and Shower Star B.V. (Seller).

Business model

- Protection of property and securing third party property against damage

MTPL and motor own damage insurance

Other non-life insurance

Financial insurance

- Accident cover

Accident insurance

Assistance services

- Securing the future of the family

Group and individually continued protection products

Individual protection insurance

- Preparations for retirement

Pillar II of the pension system – open-ended pension funds

Pillar III of the pension system (employment pension products - EPP, individual pension accounts – IKE and individual pension security accounts – IKZE)

- Increasing savings

Participation units in investment funds

Structured product

- Health care

Health insurance

Medicine insurance

Healthcare services: general health care and additional services packages

Our structure

We provide peace of mind and a sense of safety for 16,000,000 Customers in Poland

- exclusive agents

- 9,100

- branches

- 414

- multiagencies

- 3,200

- Internet call centre